Linda Krull

Campbell, John, Dan Dhaliwal, Linda Krull, and Casey Schwab. "U.S. Multinational Corporations' Foreign Cash Holdings: An Empirical Estimate and the Impact of the Tax Cuts and Jobs Act of 2017 on the Value of Foreign Cash." Review of Accounting Studies, forthcoming. https://doi.org/10.1007/s11142-025-09888-2.

Guenther, David A., Linda K. Krull, and Brian M. Williams. "Identifying Different Types of Tax Avoidance: Implications for Empirical Research." Journal of the American Taxation Association 43, no. 1: 27-50. https://doi.org/10.2308/jata-17-044.

De Simone, Lisa, Jing Huang, and Linda Krull. "R&D and the Rising Foreign Profitability of U.S. Multinational Corporations." The Accounting Review 95, no. 3: 177-204. https://doi.org/10.2308/accr-52620.

Huang, Jing, Linda Krull, and Rosemarie Ziedonis. "R&D Investments and Tax Incentives: The Role of Intra-Firm Cross-Border Collaboration." Contemporary Accounting Research 37, no. 4: 2523-2557. https://doi.org/10.1111/1911-3846.12588.

Blouin, Jennifer, Linda Krull, and Leslie Robinson. "A Festschrift in Honor of Harry Grubert: Harry's Influence on the Research of Academic Accountants." National Tax Journal 72, no. 1: 215-236. https://doi.org/10.17310/ntj.2019.1.08.

Davis, Angela K., David A. Guenther, Linda K. Krull, and Brian M. Williams. "Do Socially Responsible Firms Pay More Taxes?" The Accounting Review 91, no. 1: 47-68. https://doi.org/10.2308/accr-51224.

Blouin, Jennifer L., Linda K. Krull, and Leslie A. Robinson. "Is U.S. Multinational Dividend Repatriation Policy Influenced by Reporting Incentives?" The Accounting Review 87, no. 5: 1463-1491. https://doi.org/10.2308/accr-50193.

Blouin, Jennifer, and Linda Krull. "Bringing it Home: A Study of the Incentives Surrounding the Repatriation of Foreign Earnings under the American Jobs Creation Act of 2004." Journal of Accounting Research 47, no. 4: 1027-1059. https://doi.org/10.1111/j.1475-679X.2009.00342.x.

Brown, Jennifer L., and Linda K. Krull. "Stock Options, R&D, and the R&D Tax Credit." The Accounting Review 83, no. 3: 705-734. https://doi.org/10.2308/accr.2008.83.3.705.

Dhaliwal, Dan S., Merle M. Erickson, and Linda K. Krull. "Incremental Financing Decisions and Time-Series Variation in Personal Taxes on Equity Income." Journal of the American Taxation Association 29, no. 1: 1-26. https://doi.org/10.2308/jata.2007.29.1.1.

Dhaliwal, Dan, Linda Krull, and Oliver Zhen Li. "Did the 2003 Tax Act Reduce the Cost of Equity Capital?" Journal of Accounting and Economics 43, no. 1: 121-150. https://doi.org/10.1016/j.jacceco.2006.07.001.

Dhaliwal, Dan, Linda Krull, Oliver Zhen Li, and William Moser. "Dividend Taxes and Implied Cost of Equity Capital." Journal of Accounting Research 43, no. 5: 675-708. https://doi.org/10.1111/j.1475-679X.2005.00186.x.

Krull, Linda K. "Permanently Reinvested Foreign Earnings, Taxes, and Earnings Management." The Accounting Review 79, no. 3: 745-767. https://doi.org/10.2308/accr.2004.79.3.745.

Scharpf Professor of Accounting David Guenther was also named the Stewart Distinguished Professor for 2017.

A new sports product program in Portland, targeted options for career experience opportunities, the greatest giving campaign in the history of the university, and more.

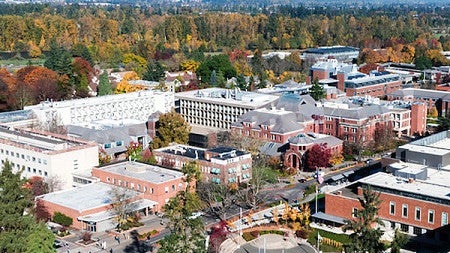

We are one of only 177 business schools that are accredited in both business and accounting. This elite status is due in no small part to our exceptional Department of Accounting.