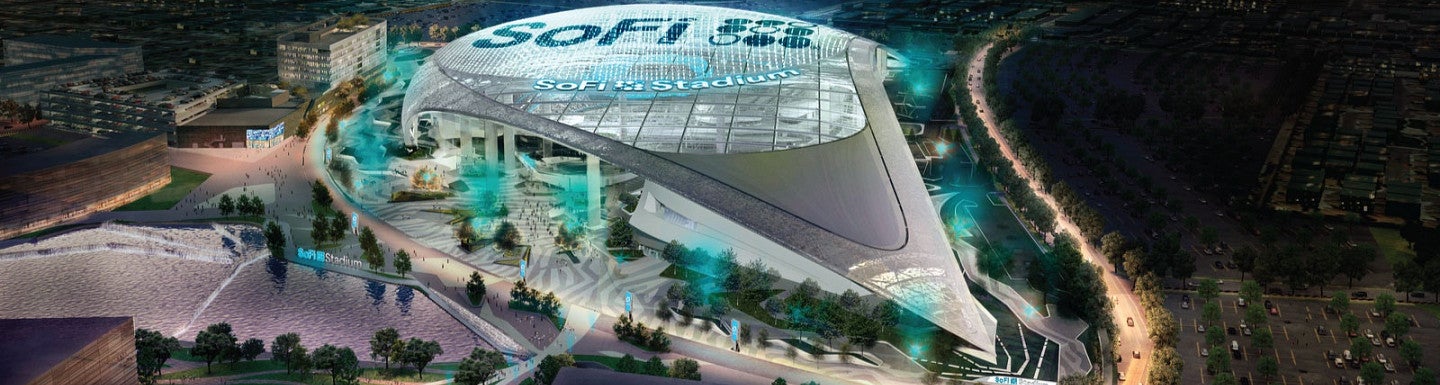

From the San Francisco 49ers’ home Levi’s Stadium to Seattle’s Climate Pledge Arena—sponsored by Amazon—corporate sponsorship is a major element of the professional sports industry. But how do these sponsorship decisions affect stock returns for the partnering firms?

Although previous academic studies show mixed results, offering fresh insight is a recent meta-analytic review from Youngbum Kwon and T. Bettina Cornwell, professor, head of the marketing department, and the academic director at the Warsaw Sports Marketing Center at the Lundquist College of Business.

Combining 34 existing studies, hundreds of data points, and more than 20 years of research in their meta-analysis, Kwon, of Pusan National University in Korea, and Cornwell examined whether or not stock value was affected by corporate partnerships with sports teams.

Kwon and Cornwell recently published the findings in the paper “Sports Sponsorship Announcement and Stock Returns: a Meta-Analytic Review” in the International Journal of Sports Marketing & Sponsorship.

Prior to Kwon and Cornwell’s research, similar studies isolated to specific sponsorship announcements found mixed impact in stock price at all points in the process. The meta-analytical approach employed by Cornwell and her fellow researcher, though, revealed a significant uptick in stock value, particularly in the days leading up to when a partnership is announced.

The researchers’ area of emphasis was the event window: just before, during, and immediately after a corporate sports sponsorship announcement; they also controlled for confounding variables in the marketplace, such as the death of a CEO, among other examples.

The conclusions make sense, according to Cornwell.

“There are a lot of people involved in the decision to spend millions of dollars on a team or league sponsorship for naming rights,” she explained, from those involved on the corporate side of the process, to those employed by the team, and any number of lawyers or other tertiary role players.

For this reason, news of an impending corporate sports sponsorship announcement is bound to leak, affecting the price of stock.

It’s informative to know that across all these studies stock prices went up in the early window, increasing the value of sponsoring firms, Cornwell said.

What’s also illustrated in Kwon and Cornwell’s research is the importance of meta-analysis. Because of the size and scope, similar studies lacked adequate data points to draw similar conclusions to Kwon and Cornwell analysis.

Through a numerical reassessment of the findings across all these studies, however, a different picture emerged, Cornwell said.

In any one study, “you don’t get the power you get when you look across studies,” she continued. “You start to see a different story through the power of meta-analysis.”

—William Kennedy, Lundquist College Communications