Diane Del Guercio

Del Guercio, Diane, and Tracie Woidtke. "Can Strong Corporate Governance Mitigate the Negative Influence of 'Special Interest' Shareholder Activists? Evidence from the Labor Market for Directors." Journal of Financial and Quantitative Analysis 54, no. 4: 1573-1614. https://doi.org/10.1017/S0022109018001217.

Del Guercio, Diane, Egemen Genc, and Hai Tran. "Playing Favorites: Conflicts of Interest in Mutual Fund Management." Journal of Financial Economics 128, no. 3: 535-557. https://doi.org/10.1016/j.jfineco.2017.04.012.

Del Guercio, Diane, Elizabeth R. Odders-White, and Mark J. Ready. "The Deterrent Effect of the SEC's Enforcement Intensity on Illegal Insider Trading: Evidence from Run-Up Before News Events." Journal of Law and Economics 60, no. 2: 269-307. https://doi.org/10.1086/693563.

Del Guercio, Diane, and Jonathan Reuter. "Mutual Fund Performance and the Incentive to Generate Alpha." Journal of Finance 69, no. 4: 1673-1704. https://doi.org/10.1111/jofi.12048.

Del Guercio, Diane, and Paula A. Tkac. "Star Power: The Effect of Morningstar Ratings on Mutual Fund Flow." Journal of Financial and Quantitative Analysis 43, no. 4: 907-936. https://doi.org/10.1017/S0022109000014393.

Del Guercio, Diane, Laura Seery, and Tracie Woidtke. "Do Boards Pay Attention when Institutional Investor Activists 'Just Vote No'?." Journal of Financial Economics 90, no. 1: 84-103. https://doi.org/10.1016/j.jfineco.2008.01.002.

Del Guercio, Diane, Larry Y. Dann, and M. Megan Partch. "Governance and Boards of Directors in Closed-end Investment Companies." Journal of Financial Economics 69, no. 1: 111-152. https://doi.org/10.1016/S0304-405X(03)00110-7.

Del Guercio, Diane, and Paula A. Tkac. "The Determinants of the Flow of Funds of Managed Portfolios: Mutual Funds versus Pension Funds." Journal of Financial and Quantitative Analysis 37, no. 4: 523-557. https://doi.org/10.2307/3595011.

Del Guercio, Diane, and Jennifer Hawkins. "The Motivation and Impact of Pension Fund Activism." Journal of Financial Economics 52, no. 3: 293-340. https://doi.org/10.1016/S0304-405X(99)00011-2.

Del Guercio, Diane. "The Distorting Effect of the Prudent Man Laws on Institutional Equity Investments." Journal of Financial Economics 40, no 1: 31-62. https://doi.org/10.1016/0304-405X(95)00841-2.

Del Guercio, Diane, and Hai Tran. "Institutional Investor Activism." In Socially Responsible Finance and Investing: Financial Institutions, Corporations, Investors, and Activists, edited by H. Kent Baker and John R. Nofsinger: 359-380. Hoboken, NJ: John Wiley and Sons, Inc. https://doi.org/10.1002/9781118524015.

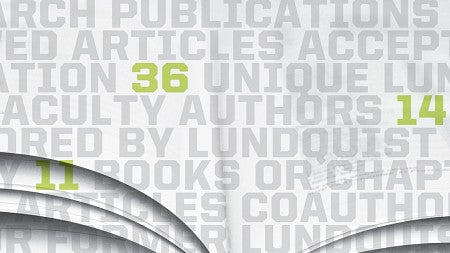

When it comes to finance, the Lundquist College has much to quack about of late. Read some of its recent activities and achievements.

Twelve Lundquist College faculty and staff members were the recipients of awards for their hard work over the 2016-2017 academic year.